The Rise of the Digital Twin: A Comprehensive Guide to AI Avatars

2/4/2026

Empowering the Future with Cutting-Edge AI Technology, Intelligent Innovations, and Transformative Solutions.

Consult With It Advisor? Click Now

India’s BFSI sector is at the crossroads of a generational technology transformation. Digital payments are exploding as the UPI transactions alone grew 56% in just one year, with 7 billion payments expected every month. This means banks need to deliver faster, smarter, and more secure services than before.

But here's the challenge: Most banks are still running on decades-old technology that wasn't built for this pace.

At AI Loop Technologies, we're helping banks make this transformation happen. Through secure cloud modernization services and GenAI, financial institutions can finally leave legacy systems behind and build the intelligent, agile, and compliant operations they need.

Here's the truth: most banks aren't struggling because they lack funding. The real obstacles are:

Before modernization delivers innovation, it must deliver security. The shift to cloud and AI must comply with RBI, SEBI, and IRDAI regulations.

For years, many Indian banks were cautious about moving critical operations to the cloud. That has now changed. The Reserve Bank of India (RBI) has issued clear guidelines on cloud outsourcing, ensuring data localization, encryption, and strict vendor accountability. This has opened the door for large-scale, compliant cloud adoption.

This shift is driven by the fact that modern cloud platforms offer greater security, flexibility, and agility than traditional on-premises systems. They allow banks to process huge transaction volumes, integrate advanced analytics, and scale instantly, all while maintaining compliance.

In short, cloud modernization services are no longer just an IT upgrade; they’re the foundation for every digital initiative in modern banking.

Generative AI isn't just a buzzword. It's actively reshaping how banks operate, serve customers, and manage risk.

Traditionally, underwriting was manual, paper-heavy, and time-consuming. Today, AI models analyze structured data (like income, credit score, and repayment history) along with unstructured data (emails, documents, conversations) to evaluate risk faster and more accurately.

Impact: GenAI can make loan processing up to 25 times faster and improve credit scoring accuracy by over 80%.

Leading banks are putting this into action:

These banks are speeding up approvals, reducing bias, and improving access to credit through a secure cloud modernization strategy.

With digital channels booming, the risk of cyber fraud and data breaches has grown. AI and GenAI are now at the center of the BFSI sector’s defense strategy.

Modern AI systems track millions of transactions in real time, identifying unusual patterns that might signal fraud or money laundering. AI models have improved detection accuracy for suspicious transactions by over 60%. GenAI adds a new layer of defense:

Companies like Bajaj Finserv are already using GenAI to design adaptive fraud verification systems.

Crucially, cloud modernization provides the necessary unified logging and scalable data infrastructure for GenAI to ingest and analyze massive volumes of security data, detecting both transaction fraud and advanced cyber threats.

Instead of customers manually filling out forms, AI can now:

Conversational GenAI chatbots can guide customers through the entire KYC process, instantly answer questions, and even interpret poorly photographed documents. This results in faster onboarding, better compliance, and happier customers.

Indian customers today expect personalized, 24×7 service, and AI is making it possible.

Banks are using AI-powered chatbots and voice assistants. They understand regional dialects, answer queries, and even suggest products based on behavior.

A 2024 EY survey found that nearly 70% of financial institutions in India are now using AI to improve customer experience.

Compliance has always been one of the most complex areas for BFSI. The rise of RegTech (regulatory technology) is simplifying this through AI and automation.

Indian banks now use cloud-based compliance platforms to automate KYC, AML, and reporting. These systems continuously track transactions and flag anomalies in real time.

Impact: AI-driven RegTech solutions helped banks cut manual compliance workloads by upto 40%.

GenAI adds further value by:

With RegTech growing at nearly 38% CAGR in India, automation and AI are becoming essential for managing compliance effectively and transparently.

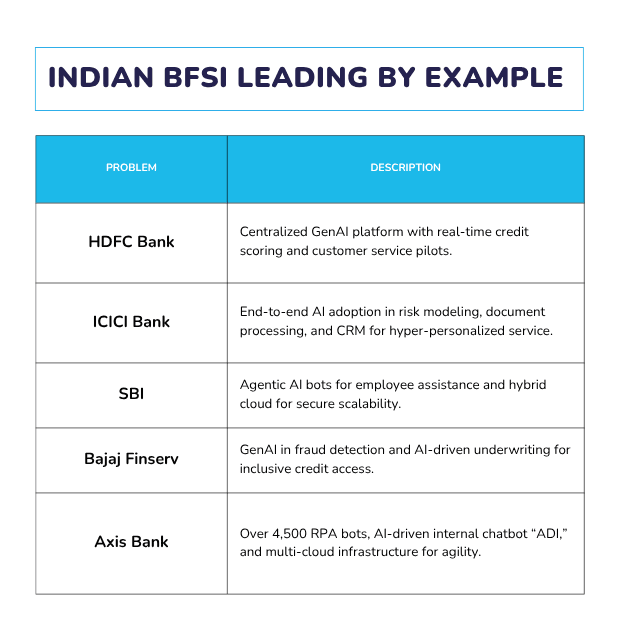

Let’s look at how some Indian players are putting all this into practice:

These initiatives show that India’s BFSI sector is now operationalizing AI and cloud at scale.

Identify critical systems, dependencies, and regulatory constraints. Evaluate current infrastructure against RBI’s guidelines and data localization norms.

Adopt a hybrid or multi-cloud model. Start with non-critical workloads, use containerization, and ensure end-to-end encryption.

Use GenAI for predictive analytics, credit risk scoring, data creation, and smart automation.

Use AI-driven tools to track performance, detect anomalies, and enable real-time compliance reporting. This phase ensures the system remains secure, agile, and scalable post-modernization.

This stepwise approach minimizes downtime, strengthens governance, and accelerates transformation.

Cloud Modernization and GenAI are the foundation of India’s next-gen financial ecosystem.

Together, they are making banking faster, safer, and more human-centered. As RBI, SEBI, and other regulators tighten compliance frameworks, the direction for the industry is clear. BFSI players that embrace secure cloud infrastructure and adopt GenAI responsibly will shape the future of finance in India.

Join our exclusive webinar, "Secure Cloud Modernization Powered by GenAI". In this webinar, AI Loop Technologies' cloud and AI experts will unpack the step-by-step roadmap to modernize banking systems securely. We will also unlock real GenAI use cases in lending, fraud detection, and customer experience.

Don’t just adapt - lead the next era of secure, intelligent BFSI transformation.